Eng

Es

It

Sp

JOANN CATHCART-LAWRENCE

Assessor

A note from the Assessor...

“I am honored to serve as the Assessor for the residents of Greenlee County.” It is the Assessor’s responsibility to locate, identify and appraise at current market value all taxable property in Greenlee County and to process exemptions as specified by law. This includes maintaining property ownership, parcel maps, exemptions, mobile homes, and business personal property

Our office strives to provide the highest quality, friendly customer service while ensuring fair and equitable valuation of all taxable property in Greenlee County. We are committed to doing what is right, honest, and accurate while being transparent with property owners and the public. Our office enjoys serving the people of Greenlee County. Stop in to see us!

Please note:

Assessor legal descriptions may be condensed and/or abbreviated for assessor purposes only.

News from the Assessor’s Office ….

Personal Property 2024 Notices of Value

Anticipated Mail Date: June 19, 2024

Appeal Deadline Date: July 19, 2024

Voters Approve Property Tax Exemption Proposition

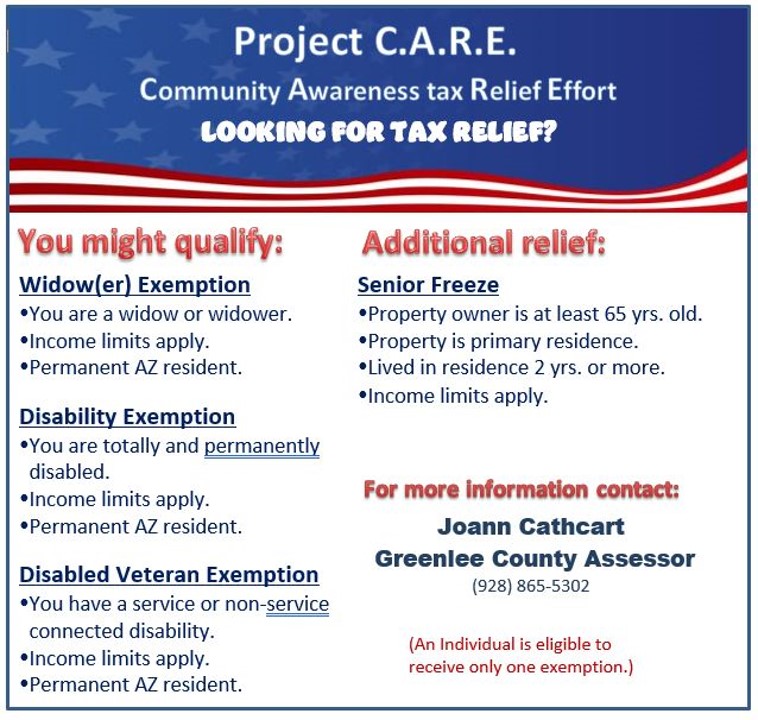

Proposition 130 has restored personal exemptions for veterans with disabilities regardless of when they became an Arizona resident or if the disability is connected to their military service. Please note an individual is eligible to receive only one exemption category: widow, widower, total & permanent disabled or disabled veteran; and income and property valuation limits apply.

HB 2064 Signed in Law

With the Passage of HB2064 registered nurse practitioners and physician assistants can now sign the Arizona Department of Revenue Certificate of Disability, certifying that an individual is totally and permanently disabled.

For answers to your tax questions please contact the Greenlee County Treasurer’s Office at (928) 865-3422.

Contact Me

Connect With the County

Greenlee County Government

253 5th St

Clifton, AZ 85533

Mon – Fri: 8:00 am – 5:00 pm

County Resources

Greenlee County News & Updates

The latest County news, articles, and resources, delivered to your inbox automatically.